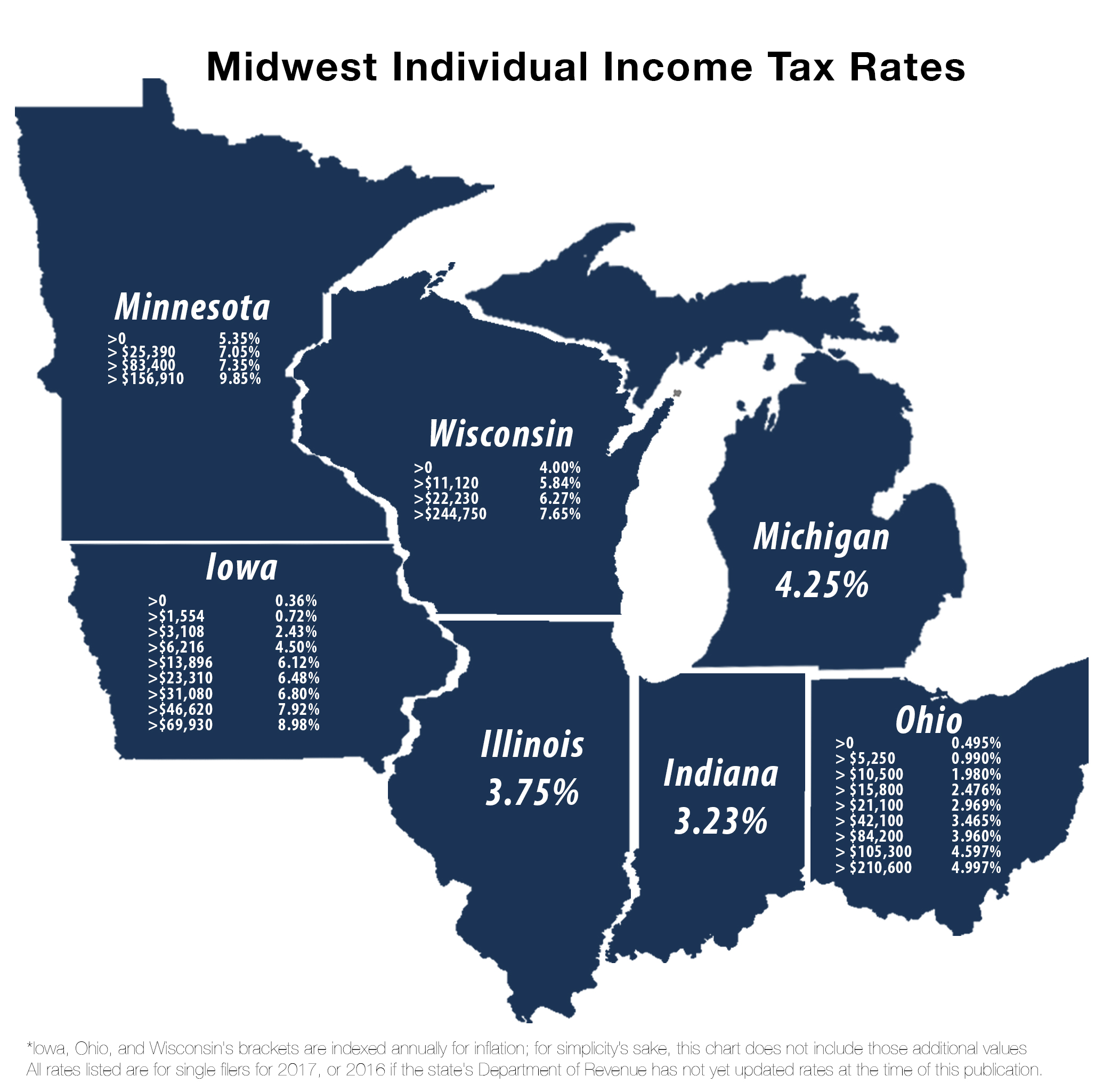

Wisconsin Income Tax Brackets 2025. There is a statewide income tax in wisconsin. This tax is applied based on income brackets, with rates increasing for higher levels of income.

R251,258 + 41% of taxable income above r857,900. Beginning in 2025, the rate will be reduced by 0.1 percent annually until the rate reaches 4.99 percent.

Wisconsin Tax Reform Options to Improve Competitiveness, You might have a little extra money in your bank account in 2025 due to the irs changing the federal income tax brackets for the 2025 tax year to. Wisconsin's 2025 income tax ranges from 3.54% to 7.65%.

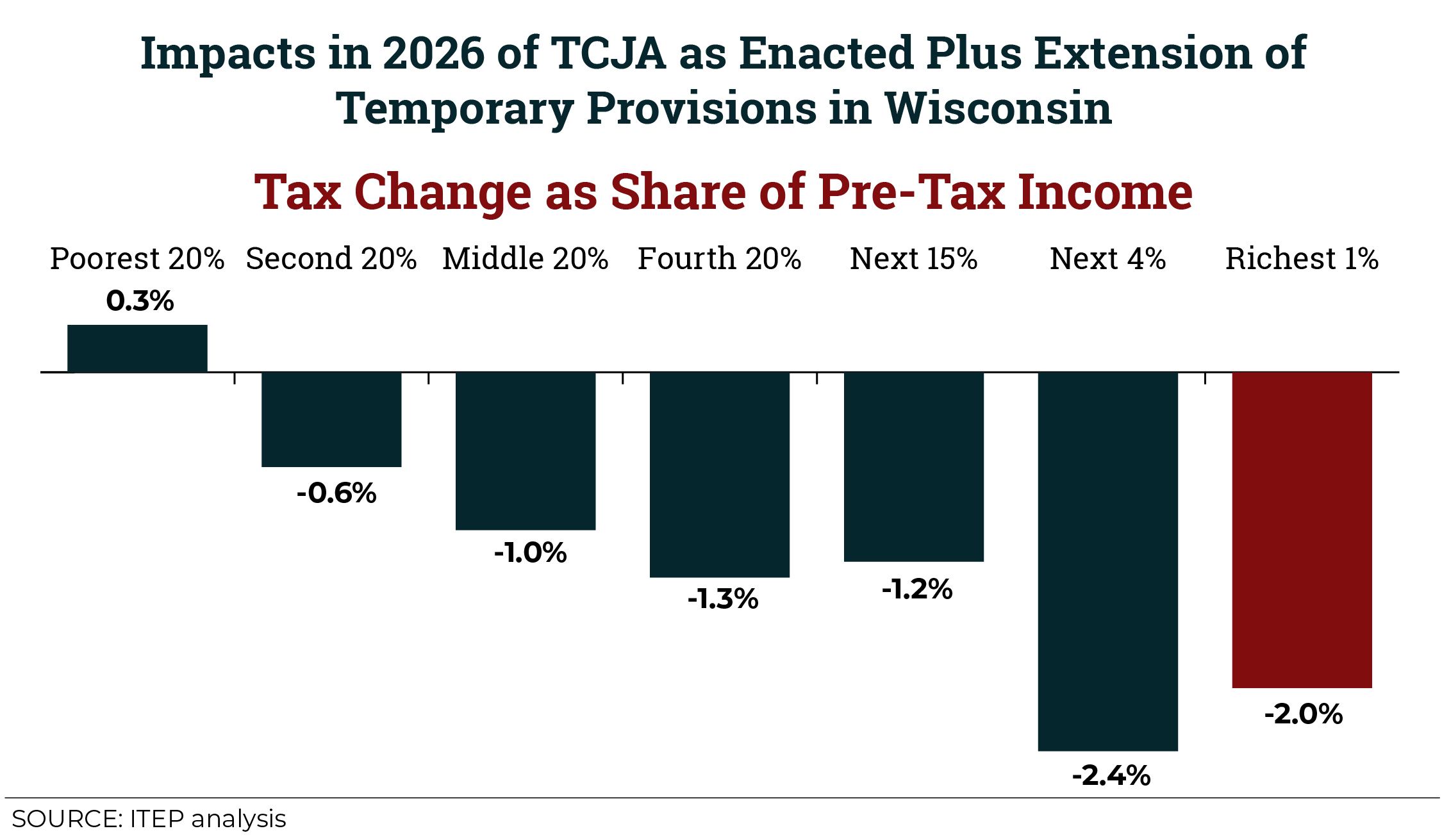

T200018 Baseline Distribution of and Federal Taxes, All Tax, On thursday, march 21, wisconsin gov. Estimate your tax liability based on your income, location and other conditions.

Middle Tax Reform Options for Wisconsin CROWE UWMadison, Wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. Stay informed about tax regulations and calculations in wisconsin in 2025.

A Glide Path to a 3 Percent Flat Tax MacIver Institute, The individual income tax filing requirements for wisconsin residents and nonresidents for 2025 are presented in the chart below. Beginning in 2025, the rate will be reduced by 0.1 percent annually until the rate reaches 4.99 percent.

Tax Cuts 2.0 Wisconsin ITEP, Stay informed about tax regulations and calculations in wisconsin in 2025. The 2025 tax rates and thresholds for both the wisconsin state tax tables and federal tax tables are comprehensively integrated into the wisconsin tax calculator for 2025.

wisconsin tax tables, The individual income tax filing requirements for wisconsin residents and nonresidents for 2025 are presented in the chart below. Stay informed about tax regulations and calculations in wisconsin in 2025.

Wisconsin 2025 Tax Brackets Abbe Jessamyn, Stay informed about tax regulations and calculations in wisconsin in 2025. This tax is applied based on income brackets, with rates increasing for higher levels of income.

Estimated Taxes 2025 Based On 2025 Tax Return Status Annora Zandra, Here you can find how your wisconsin based income is taxed at different rates within the given tax. R251,258 + 41% of taxable income above r857,900.

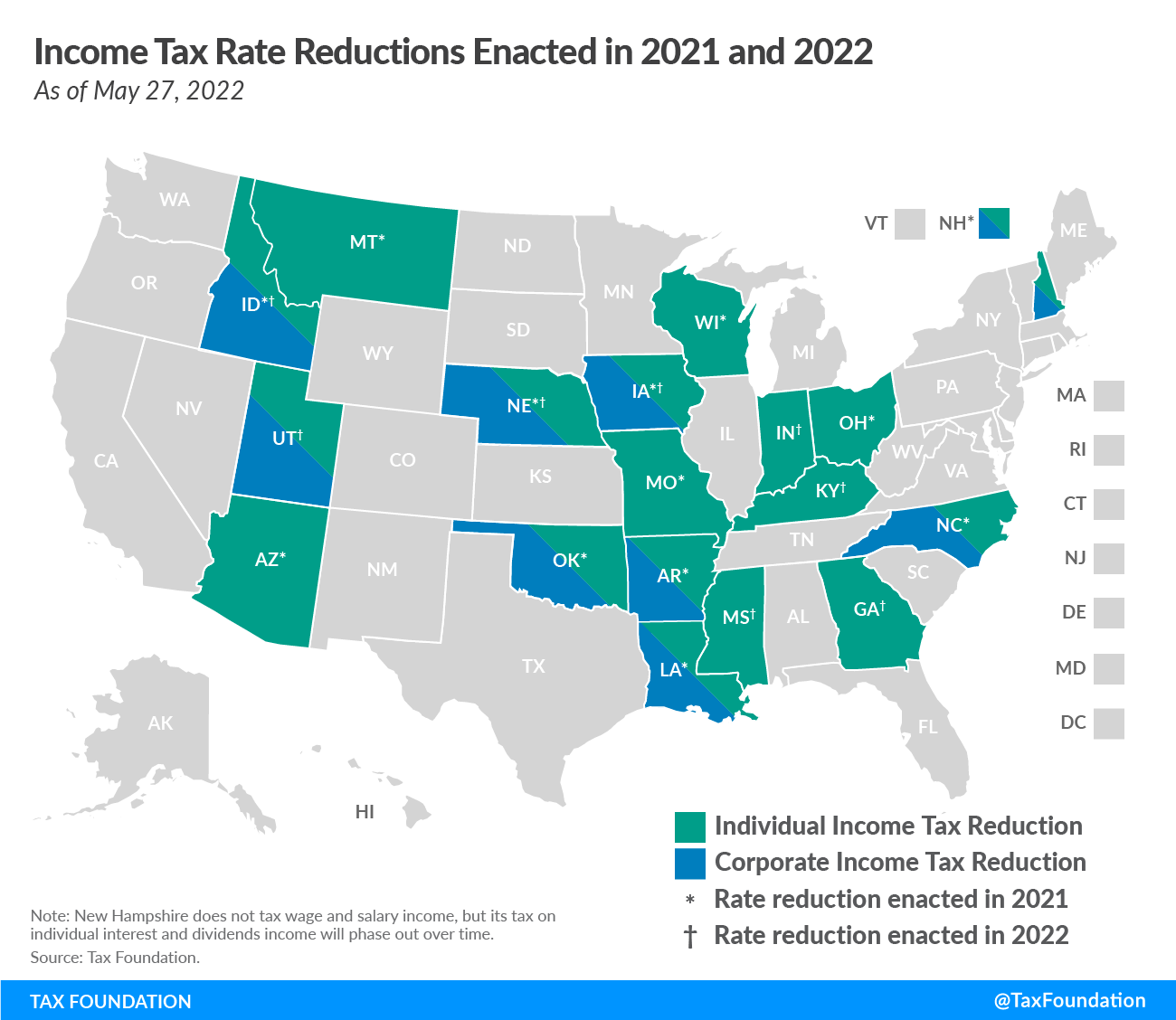

Wisconsin Losing Ground to TaxFriendly Peers Tax Foundation, Tony evers signed into law many bills that affect a broad range of wisconsin tax types. Income tax brackets, rates, income ranges, and estimated taxes due.

Tax Rates 2025 2025 Image to u, The individual income tax filing requirements for wisconsin residents and nonresidents for 2025 are presented in the chart below. Stay informed about tax regulations and calculations in wisconsin in 2025.